How to survive and thrive as a Landlord in 2024

Paul Shamplina, Founder of Landlord Action and The Landlord’s Friend shared his advice at our recent Property Investor Seminar held in Bristol.

Demand for private rental is high however there is uncertainty in the market. Read key tips on how to prosper as a landlord from one of the UK’s leading rental experts.

Rental housing is of great importance in the UK, out of approximately 23.5 million households, around 4.6 million households use the private rented sector. While the proportion of renters has remained relatively stable over time, renting from a private landlord has become more common than from a local authority or a housing association. Rent prices have been rising at a record rate in over 14 years.

In 2022, the share of households in a private rental home rose from 18.5 to 19.1. (Statista Research Department, January 29th, 2024) Over the past 20 years, the residential rental market has tripled, and an October 2022 forecast suggest that rents will continue to rise until 2026 with many people unable to afford to buy a home, demand for rental housing is expected to remain strong. This is confirmed by the average void period, which has remained consistently below 30 days (Statista Research May 4, 2023) across the country since November 2020.

In 2023, 153,000 properties were sold in the private rental sector and 12% of NRLA members sold properties in the last three months however it is important to consider the context to this data. 4.6 million houses, 19% of the housing market is in the private rented sector and demand remains high.

Private rental prices paid by tenants rose by 6.2% in the 12 months to December 2023, unchanged from the annual percentage change in the 12 months to November 2023.

In 2024 there will be a reset within the housing sector following on from the General Election however supply and demand issues are not likely to reduce over the next five years.

Here are some key tips on surviving:

1) Do your market research

- Consider BMV - below market value deals

- Seek properties in areas of high demand

2) Undertake good tenant referencing

- During times of uncertainty minimize your risk by checking affordability; undertake credit checks, request bank statements, request employer and previous landlord reference.

- Ask for proof of address and identity, right to rent certification and confirm guarantors.

3) Refresh yourself on legislative compliance

- Ensure you are up to date on licensing.

- Check with your local council to ensure you are aware of legislative changes.

4) Don't waste time

- Are you wasting time running the tenancy yourself? Do a cost analysis on the benefits of a fully managed versus let only.

- Technology can save you time using things such as smart locks, virtual tours, smart meters.

5) Educate yourself

- Join your local landlord social media group

- Read landlord media like Landlord Zone

Here are some key tips on thriving:

1) Get yourself a ‘Power team’

- Have a list of go-to tradesmen, suppliers, agents, education providers, mentors and other landlords

2) Review your portfolio and the market

- Register with local agents for property alerts

3) Assess mortgage rates

- Is your money working hard for you?

4) Understand your strengths and weaknesses

- Where is your time best spent?

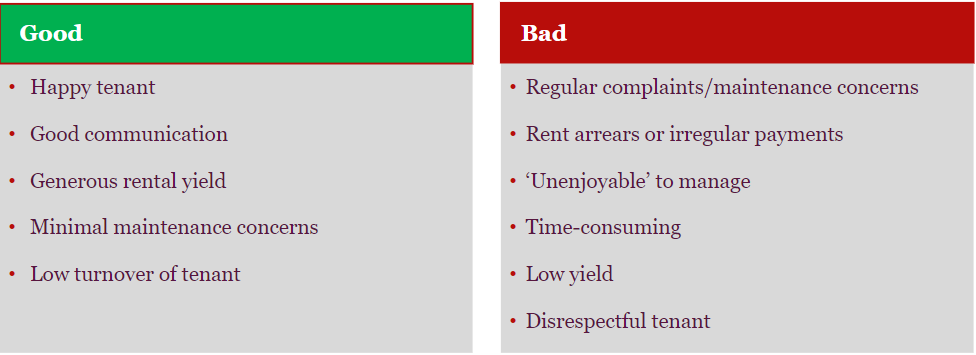

5) Review your good vs bad stock

We will be running further seminars in 2024 and look forward to sharing analysis on the post-election landscape in the Autumn.

Angharad Trueman comments; ‘Demand for rental properties continues to be very strong and supply continues to dwindle so although it is often seen as more complicated now to be a landlord, it is still a profitable endeavour and a good place to keep your money. However, its important you are viewing this as a business decision and instructing a qualified, knowledgeable agent is the most sensible way to keep your business investment safe and profitable. Andrews can help with this; our experts operate across the South of the UK and we offer various service levels which can suit a landlord’s requirements’