Maximising Rental Yield in the UK: A Comprehensive Guide

Investing in rental properties in the UK can be a lucrative venture, provided you understand how to maximise rental yield. Rental yield is the annual rental income expressed as a percentage of the property’s value. Here’s a comprehensive guide to help you understand and improve your rental yield.

Understanding Rental Yields

Gross Rental Yield: This is calculated by dividing the annual rental income by the property’s purchase price and then multiplying by 100 to get a percentage. Gross Rental Yield = (Annual Rental Income/Property Purchase Price) × 100

Net Rental Yield: This considers all expenses associated with the property, such as maintenance, insurance, and property management fees. Net Rental Yield = (Annual Rental Income−Annual Expenses/Property Purchase Price) × 100

Factors Affecting Rental Yield

1.Location:

- High-demand areas, especially near universities, business districts, and transport links, often offer higher rental yields.

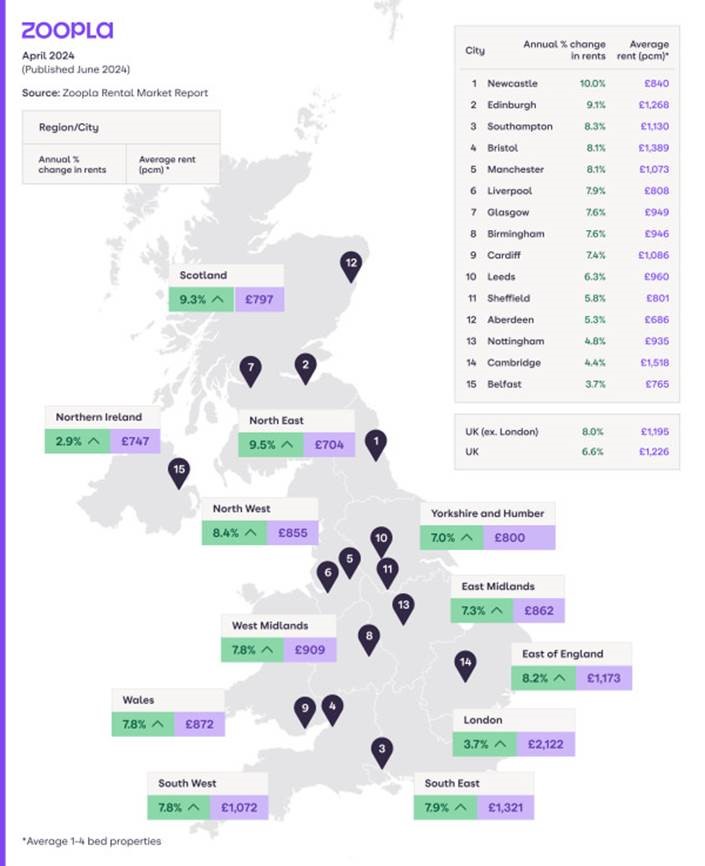

- Parts of the UK will have higher rental yields than others based on factors such as location, amenities, transport, opportunities and infrastructure.

2.Property Type:

- Smaller sized properties, like one-bedroom apartments or studios, often have higher rental yields compared to larger family homes.

- Houses in multiple occupation (HMOs) can generate higher rental yields but come with more regulations and management complexities.

3.Market Conditions:

- Economic factors, interest rates, and housing supply and demand can impact rental yields.

- Post-pandemic shifts have seen increased demand for properties with home office space and outdoor areas.

What is a good rental yield?

The ideal percentage will change depending on the location and whether it’s a residential property or student accommodation. As a general rule, a gross rental yield between 5 and 6 percent would be considered ‘good’ and anything above 7 percent would be ‘very good’.

Above all, a good net rental yield should cover all the necessary property expenses while allowing landlords to make a reasonable return on investment. When you’re looking to invest in a new property, it can be tempting to look in an area with big demand for rentals or where capital growth is high.

Research

The importance of doing the necessary research on the area you wish to invest in is crucial to ensure you maximise your return. There are two approaches investors take when selecting an area to investment in.

One approach is identifying an up and coming location. Signals to consider include, it’s on the border of a desirable area. Locations that sit on the border or within close proximity to an already popular and desirable location are generally next in line for development and regeneration. Another signal is there are a growing number of new builds. A growing number of new build developments (or associated planning applications) is a good signal that the area is on the up. It is however important to note that if there are too many new build properties in the area this could flood the market and negatively impact the value of the surrounding rental market.

Another signal is there are more development activities in the area such as plans for the building and/or opening of new schools, supermarkets, restaurants, cafes, shops and other amenities. Larger regeneration plans should also be viewed as positives. Regeneration plans provide more job opportunities and better quality of life, which means an increasing number of people are likely to want to live in the area. Transport links are being improved is also a good signal.

With new transport links, towns or villages can become attractive for commuters and make it a popular area to buy property.

These signals can lead to both an increase in the rental price of the property but also the value.

The second approach is to invest in an area that is familiar to the landlord. This could be the area they have grown up in or have an affiliation with and therefore are able to keep a close track on what the markets are doing.

It is therefore crucial to get the balance right. Having insider knowledge from having a connection within the area you choose to invest in or alternatively researching the area you are considering as an investment and looking at the signals are crucial to ensure you maximise your rental yield.

Speaking with local agents in the area will give you a better insight into the types of properties and areas within the county that are popular with tenants. They will be able to advise on the trends and demand they are experiencing and provide examples of similar properties that have been let and at what price, therefore giving you the best opportunity to calculate the accurate yield.

Conclusion

Maximising rental yield requires a combination of strategic property selection, effective management, and continuous market analysis. By focusing on high-demand locations, maintaining and upgrading your property, and setting competitive rents, you can enhance your rental income and overall investment returns. Stay informed about market trends and be proactive in adapting your strategy to ensure sustained success in the UK rental market.