Changes to Stamp Duty Land Tax

Following on from The Chancellors latest announcement that the level at which Stamp Duty Land Tax is charged has been temporarily raised until next March to £500,000, David Westgate, CEO of Andrews Property Group, shared his thoughts:

“The Chancellor’s Stamp Duty holiday is high risk but a welcome short term stimulus.

While it puts more money into pockets today, it could actually see prices increase as demand increases.

Making the much anticipated Stamp Duty cut temporary is a gamble if the economy hasn’t recovered by the spring.

It is possible that we will have a boom scenario between now and April next year when a disproportionate number of people are buying at higher prices followed by softer prices when the scheme ends with asking prices being adjusted.

Arguably the real winners will be purchasers of higher value properties who have just had £15k knocked off their completion bill, not the people it was intended for.”

What is Stamp Duty Land Tax?

Stamp duty is a tax paid by people purchasing properties in England and Northern Ireland.

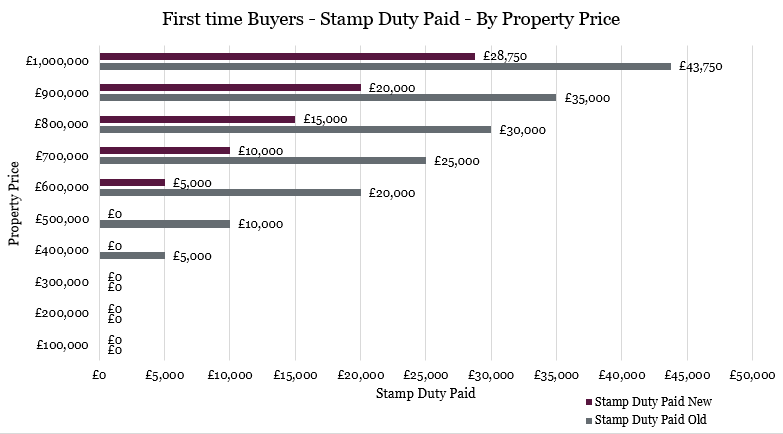

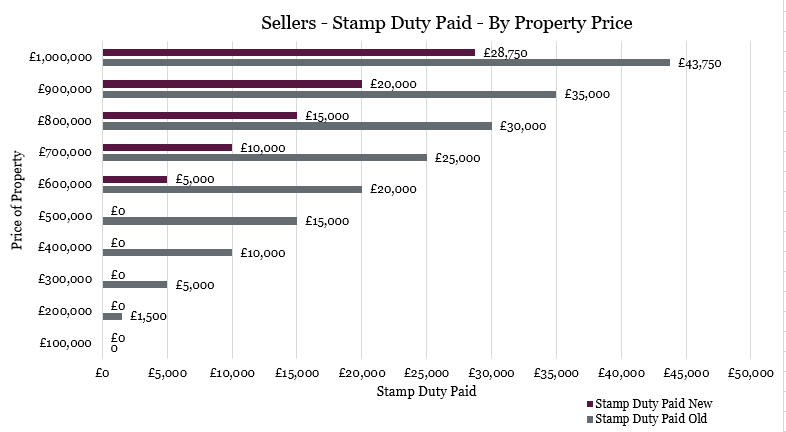

The amount of tax you pay depends on where you are in the UK, the price of the property and whether you’re a first-time buyer.

What do the changes mean?

The government has increased the lower stamp duty threshold to £500,000 for property sales in England and Northern Ireland, which means any property purchases below the new level will not need to pay stamp duty as long as the purchase is completed before 31 March 2021.

This will apply from today (8th July) until 31st March 2021 and will affect those purchasing a residential main residence. Nearly nine out of ten people getting on or moving up the property ladder will pay no SDLT at all and it’s predicated that the average stamp duty bill will fall by £4,500.

How much could you save?

Well, it will all depend on your individual circumstances and that property purchase price.

However, as an example if you are not a first time buyer purchasing a house for £275,000 then you’ll look at save around £3,750 which you would have paid previously (based on 0% stamp duty on the first £125,000, 2% on the next £125,000 plus 5% on the final £25,000).

See more below to find out how much you could look to save if you’re looking to purchase.

The change will also apply to anyone purchasing a second home and additional properties, although these will still attract a 3% second home surcharge. An investor spending £450,000 will now pay £13,500 instead of £26,000

Want to know more?

If you’re in the middle of completing a transaction and not sure how these changes may affect you, or want to find out how this could affect your future property purchase then speak to one of our property advisers on 03714543017 to discuss your circumstances.

For more information about these changes and to find out how much Stamp Duty Land Tax you will now pay please see the Government website.